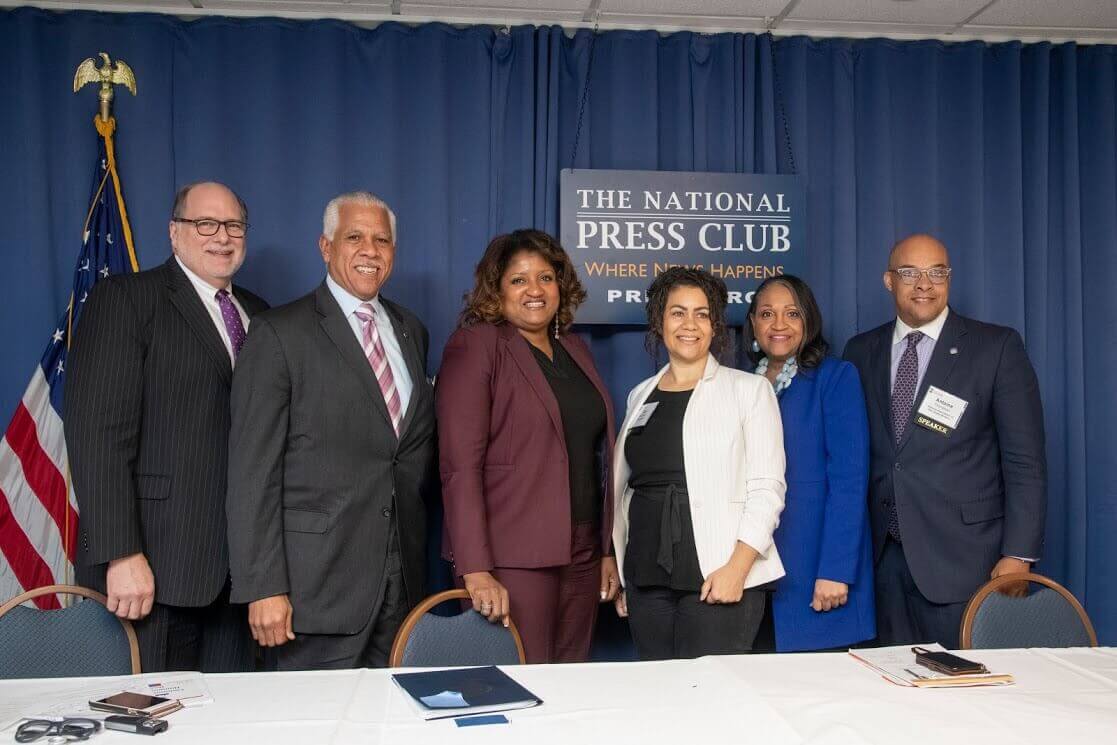

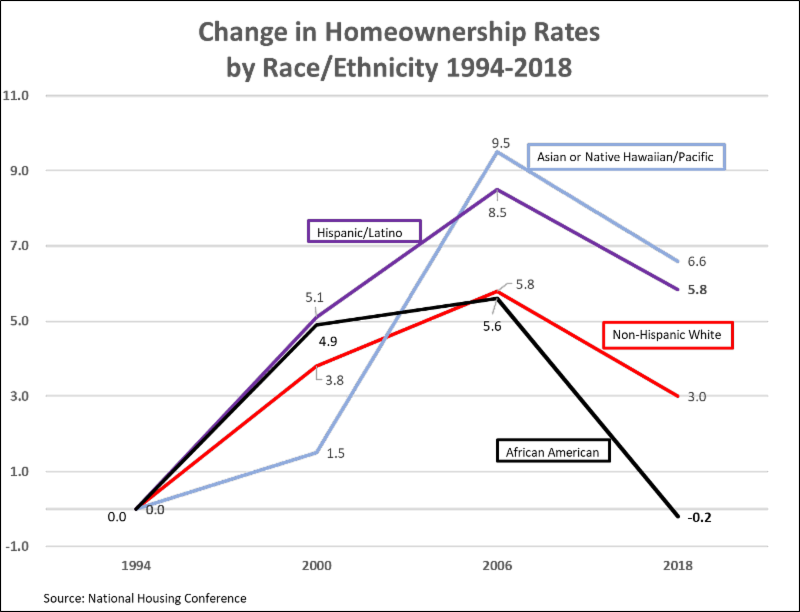

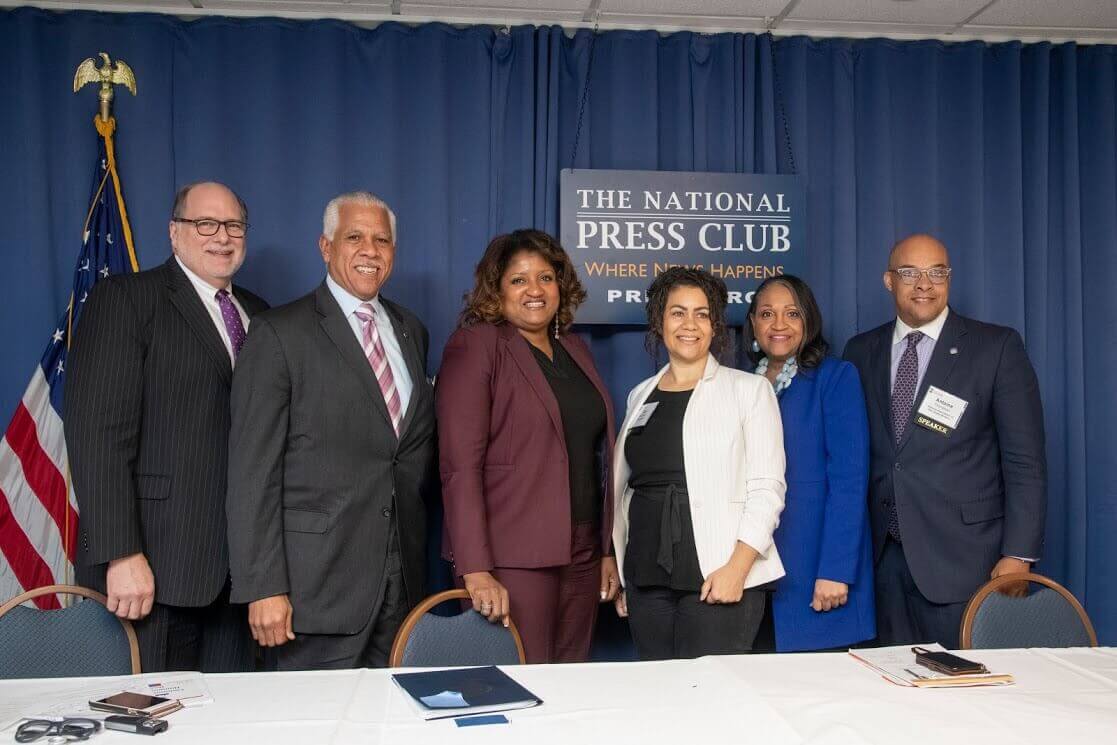

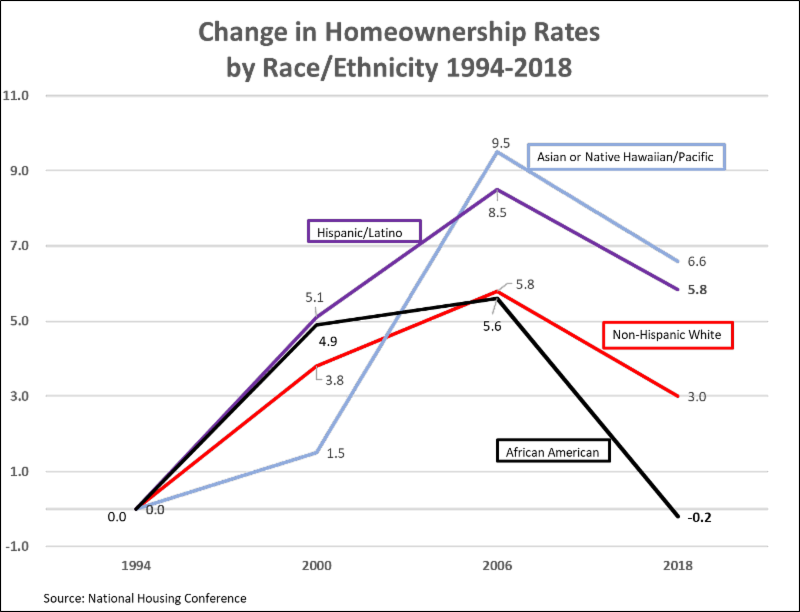

This year at our Solutions for Housing Communications we held an expert panel entitled, “Communicating on the black homeownership decline and income disparities.” This informative panel included, Lisa Rice of the National Fair Housing Alliance, Hilary O. Shelton of the NAACP Washington Bureau, Cat Goughnour of Prosperity Now and Antoine Thompson of the National Association of Real Estate Brokers. The next day, NHC assembled a group of members to have a first of many strategy sessions on how we work together to increase black homeownership, the one demographic group left behind in the post-recession housing recovery. While there are many barriers that hinder the increase of black homeowners, our Paycheck to Paycheck database shows that affordability is a double edge sword for first time homebuyers. In high cost areas, homes are too expensive; in low cost areas, smaller home loans are not available. When combined with the advent of algorithmic redlining and the experience of equity stripping in the black community, it is clear that these real and complex issues must be addressed as a community, a country and a coalition.

We join in the conversation to shine light on the hard, important and in-depth research that is being done by our fellow advocates and organizations like

Urban Institute and the

Brookings , as well as generations of advocacy by leaders like the

NAACP and the

National Urban League , among others. Over the years, in and out of government, I have learned that common problems often require uncommon solutions. This is even more true when the problems are complex and chronic. Building coalitions and consensus that work together toward a common solution is the path to success.

We are committed to working with our diverse group of over 220 members to identify and execute legislative, regulatory, marketing and outreach solutions to address the broad range of issues impacting this issue. Our first meeting, co-chaired by NAREB’s Antoine Thompson identified dozens of factors that require our focused attention. These include but are by no means limited to marketing safe financial products to the black community, dispelling myths that high down payments and perfect credit scores are required to buy a home, working with lenders to earn back the trust of the black community, and addressing the debilitating impact of rising student loan burdens.

As Lisa Rice noted at our panel discussion Tuesday, black homeownership is lower today than it was when segregation was legal before the Fair Housing Act was enacted over 50 years ago. Hilary Shelton made clear that black homeowners were disproportionately hurt by the 2009 financial crisis and black family wealth has suffered as a result. You can hear the entire panel discussion

here. While discrimination is clearly embedded into the foundation of the black homeownership gap – and in advertising algorithms today – we also must be cognizant of the fact that historic changes in law and regulation have failed to provide a meaningful and sustainable impact on the homeownership rate. If you are interested in being involved in the conversation, please email me at

tbreaux@nhc.org.