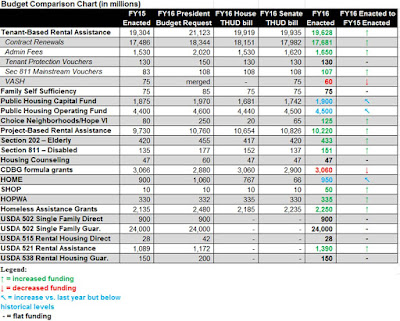

This morning the omnibus spending bill text for FY 2016 was released after weeks of negotiations. Many programs saw slight increases in funding compared to last year, but overall funding is essentially flat, especially when considered relative to rising housing costs. Of note, the HOME program, which the Senate proposed cutting from $900 million to $66 million, was restored and increased to $950 million. The chart below shows HUD and USDA funding for selected programs for FY 2015, proposed FY 2016 and actual FY 2016. Red numbers indicate decreases compared to FY 2015 enacted levels, greennumbers indicate increases, blue numbers indicate increases from FY 2015 but lower than historical levels and black numbers indicate flat funding.

Also included in the bill are provisions that:

- Allow private owners of Section 8 properties to make Family Self-Sufficiency programs (already available in participating public housing properties) available to residents. (p. 1575)

- Allow community land trusts to use HOME funds to secure site control for development of permanently affordable housing. (p. 1583)

- Keep the Self Help and Assisted Homeownership Opportunity Program (SHOP) funding separate from the HOME program. (p. 1584)

- Change the definition of “youth” for homelessness programs to now mean age 24 and under. (p. 1588-9)

- Increase Moving to Work by 100 agencies (down from the proposed 300) and provide for program evaluation. (p. 1631)

- Limit sale of Fannie Mae and Freddie Mac shares. Section 702 would prevent the Treasury Secretary from selling or otherwise disposing of the senior preferred shares in Fannie Mae and Freddie Mac that the federal government acquired during the bailout. The provision requires legislative action by Congress and the president to dispose of the shares and expresses the sense of the Congress that there should be legislation determining the future of Fannie Mae and Freddie Mac. (p. 1968)

Property-based Section 8 contract renewal funding appears slightly lower than the president’s proposed budget, but the lower number may reflect revisions by HUD to the amount needed or greater carryover from last year and do not appear to be a short-funding of contracts.

Early this morning the House also released the tax extenders bill. It appears that the tax extenders bill will be voted on separately by the House and the omnibus and tax extenders bill will be combined when sent to the Senate. Housing highlights from the bill include:

- Permanent minimum nine percent credit rate for LIHTC

- Five-year extension for New Markets

- One-year extension for Mortgage Debt Relief Act

The House is expected to vote on both bills on Friday, Dec. 18, before holiday recess. The House will need to pass a stopgap funding measure on Wednesday to prevent a government shutdown. The short-term continuing resolution will most likely run through Dec. 22 to give the Senate enough time to pass both the tax and spending bills.