What does Silicon Valley Bank have to do with Housing and Inflation? A lot. The meltdown of Silicon Valley Bank (SVB) last weekend was the product of several factors, not the least of which was terrible management. It was also caused by record low-interest rates that the Federal Reserve Board may have raised too quickly in its understandable fervor to tame inflation, and a failure of all of the banking regulators to respond more directly to obvious signs that bank balance sheets across the country were unprepared for the shift in monetary policy.

The bottom line is that SVB hedged its credit risk with low-interest, long-term securities that solved one problem (volatile deposit base) while creating another (enormous interest rate risk). When interest rates doubled in less than a year, the value of their safe investments crashed, leading depositors to panic and pull out their money. Unfortunately for housers, SVB also made a lot of loans on affordable housing deals, and was a big investor in Low-Income Housing Tax Credits (LIHTC), potentially placing thousands of affordable housing units under construction at risk.

Going forward, the Federal Reserve Board has an even harder job than bringing inflation under control and keeping the economy out of recession. Now it has to restore confidence in the banking system as well. Congress will have to responsibly exercise its oversight responsibility while deciding if the bipartisan agreement in 2018 to loosen regulatory supervision of regional banks went too far. It also must avoid pushing the economy over an even deeper cliff if it does not raise the debt ceiling. That’s a lot, so let’s unpack each piece.

What happened at SVB and why

No one should have been surprised by what happened at SVB, IF they were paying attention. One of the questions independent investigators will be looking at as they deconstruct this crisis is who missed what. SVB was a rapidly expanding bank whose growth was driven by a deposit base of startups run on venture capital. In fact, only 3% of their deposits were under the FDIC limit for deposit insurance. For a bank, this means they were taking in and spending a lot of cash from large corporate depositors who were not earning actual returns on their investments. This was a risky business model that few banks were willing to take on, but SVB was very good at underwriting the risk of startups losing venture capital. What they were NOT good at, was managing interest rate risk.

Banks have to manage four basic risk categories – credit, interest rate, counterparty, and operational risk. Much of this can be explained in the classic Christmas season film It’s a Wonderful Life. You can watch the famous run on the bank scene here. Credit quality is the likelihood that the mortgages made by the Bailey Building and Loan will pay each month. Interest rate risk is the risk that the Building and Loan will earn less income from loans than it is paying for deposits (this won’t be a serious issue for lenders until the 1970’s). Counterparty risk is the possibility that Mr. Potter will call the Building and Loan’s credit line, threatening its solvency (spoiler alert – he does). Operational risk is the possibility that Uncle Billy, the sweet family alcoholic, will lose the Building and Loan’s cash when he leaves his coat behind at Mr. Potter’s bank, having forgotten why he tied a string around his finger. SVB managed its counterparty and credit risk reasonably well, but it failed miserably in managing its interest rate and operational risk. In the biggest tragic irony of the whole debacle, the company went without a Chief Risk Officer for 8 months in 2022.

To understand interest rate risk, we need to understand the basics of a bond. Every loan the bank makes, or security it invests in, has a par value. That’s the face value of the bond – its actual value if held to maturity. The term – or duration – is the length of that maturity. It can be overnight, for 30 days, or 30 years, like a Mortgage-Backed Security (MBS). The amount of interest paid each month on the bond is called the coupon. If I buy a $1 million Treasury bill with a 2-year term and a coupon of 3% I will collect 3% interest every month for two years – and my investment will be guaranteed by the full faith and credit of the US government. The reason the interest rate is called a coupon is that when bonds were done on paper, every month of interest was represented by a perforated stamp attached to the bond and you would clip each one to redeem it for your interest payment. You could also tear off a strip of interest coupons and sell them to someone, hence the term interest rate strips.

Treasury bonds (also called notes), and government-backed MBS, have no meaningful credit risk. A novice could easily see them as the perfect way to offset or hedge the risk of SVB’s volatile deposit base. BUT they are extremely vulnerable to changes in interest rates, a factor that SVB and its regulators appear to have completely ignored. It’s as if the very bright people at SVB did so well on the Economics 101 midterm, they never went back to class. If they had, they would have learned why those super-safe bonds were so extraordinarily risky.

The problem with SVB’s bond portfolio was that low-interest rates didn’t stay low forever. If I own a 3% bond and I want to sell it to you when rates are 3%, you’ll pay 3%. If rates are 2% you will pay a little more for the extra interest you’ll be earning. But if rates go to 7%, as they did, that bond is going to be worth a lot less since it’s earning less than half of what you could get on the market. This is called duration risk, and it’s the part that SVB, and many other banks, seemed to forget. When the Fed started raising rates, the value of those bonds began to fall. Billions of dollars were pouring into and out of the bank constantly. But the duration of SVB’s bonds was very long – 30 years, in most cases. Under generally accepted accounting principles (GAAP), those bonds can be valued as an asset at their par value as long as they are going to be held to maturity. If their actual market value is below their par value, they are treated as an “unrealized loss” but not valued as a loss. But if you intend to sell them early, or have to sell them immediately, even though you thought you weren’t, that unrealized loss is very real.

SVB’s unrealized losses grew rapidly through 2022, and some big depositors noticed and got very concerned – rightly so in my opinion. They started talking to each other about finding a new bank. At one point, it was reported that customers withdrew $40 billion in a few hours. By the time Mark Tluszcz, CEO of Mangrove Capital, tweeted: “If you are not advising your companies to get the cash out, then you are not doing your job as a board member or as a shareholder,” the run was a mad dash.

This has led some to blame Twitter and modern communications for the run on the bank, but I believe that is grossly overstated. Social media speed has simply kept up with the speed of banking. In 1929, long before Twitter, or cell phones, or computers, or frankly, before many rural Americans had their own telephone lines, bank runs wiped out financial institutions in a few days. Over just a few months in 1929, 650 banks failed. In 1931, New York’s Bank of the US lost nearly $200 million in less than a month – $4 billion in today’s value, making it the worst bank failure over the next 53 years.

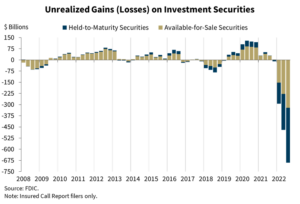

The risk of this collapse, at SVB or at many other banks with huge portfolios of MBS, should have been obvious to banking regulators in December when the FDIC published this chart showing massive and unprecedented unrealized losses on investment securities. This isn’t a chart of SVB – it’s a chart that represents all banks in the banking system. That’s part of the reason the Fed and FDIC were so quick to identify SVB as a systemic threat. It also raises the question of why they didn’t respond sooner. Anyone checking their bank’s balance sheet could have panicked just as easily as SVB’s customers, though withdrawals would not have been nearly as large.

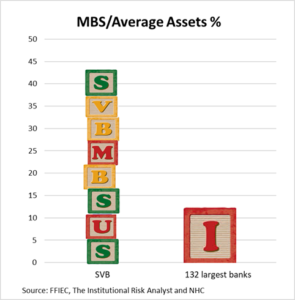

Another factor that made SVB unique was the extremely large exposure the bank had to its MBS investments, far outpacing their peers. This chart was prepared by R. Christopher Whalen in the Institutional Risk Analyst on March 13. Whalen notes that SVB had 43% of its total assets in MBS compared to an average of 12% for the 132 largest U.S. banks. When I explain the 2008 crisis, I often refer to the Jenga puzzle scene in the movie The Big Short. It explains how parts of toxic mortgages can be blended with parts of good mortgages to created a highly complex toxic security (yes, it’s true, you can learn everything you need to know about the 2008 housing crash in just under eight minutes). This is nothing like the 2008 crisis. In fact, anyone who suggests that it is, clearly has no idea what they are talking about. 2008 was a failure of the so-called “smartest guys in the room.” SVB is more like kindergarten math gone wrong. The chart below sums it up. The blocks on the left are less stable than the blocks on the right. They could not withstand the change in rates. As soon as they fell, investor analysts started looking at other banks that could be similarly exposed and the threat of contagion, and systemic risk, grew exponentially.

How is housing involved?

Unlike the 2008 meltdown, housing is not the cause of this crisis, but it is directly impacted. Some may point to the fact that SVB invested in MBS, but these were highly rated securities made of high quality mortgages with a more than implicit guarantee from the U.S. government as Fannie Mae and Freddie Mac are in federal conservatorship. However, SVB and Signature Bank, the two banks taken over by the government, had made significant investments in affordable housing developments through loans and LIHTC investments. Systemically, the flight to quality away from the stock market and to the government bond market will lower interest rates at a time the Fed was counting on higher rates to reduce inflation.

After reaching out to our members with affordable housing investments in California, I shared four questions with the administration and housing regulatory agencies. Clear and public responses will be necessary to avoid killing much-needed affordable housing developments and quell the fears of housing developers and tax credit investors.

- Are existing debt obligations like construction loans wiped out with the bondholders, or preserved with the depositors?

- How will construction loans be funded so current developments are not interrupted or canceled?

- Are special permissions needed to replace SVB as a limited partner in tax credit investments?

- Will developers need extensions from the state Treasurer and the IRS on LIHTC placed-in-service deadlines to accommodate any delays?

While I have heard second hand that some projects may have received construction draws since SVB was taken over by the FDIC, there is still widespread confusion. The situation with LIHTC investment is even less clear. Treasury and the FDIC need to issue clear statements that respond to these questions. If necessary, Treasury or the Fed should develop mechanisms to preserve projects underway.

Now what?

The hardest question will be faced by the Federal Open Markets Committee (FOMC) when it meets this week. Many analysts expected the Fed to raise rates at least 25 basis points, with a 50 basis point increase deemed likely. Now speculation is common that the Fed will hold steady, or raise 25 basis points at most. The problem is that interest rates are already lower because of the events of the past week. And inflation is still too high, especially in shelter. I don’t envy the FOMC the difficult choices ahead of it.

The choices for Congress are more clear. The debt ceiling must be raised without conditions. Any game of chicken over the debt ceiling will spook markets, and a breach of the debt limit will throw the country into economic chaos. Congress should hold genuinely bipartisan hearings in the House and Senate to thoroughly explore what happened and why. A review by Federal Reserve Vice Chair Michael Barr is already underway. We need to understand the mistakes that were made and the risks that remain. If changes to the regulatory structure of regional banks are needed, they should be done in the same bipartisan spirit under which they were loosened. That may be asking too much, as progressives have and will demand a reversal of all changes made in 2018 and may want even more regulation, while conservative libertarians will likely suggest less regulation is needed, or that regulation is to blame. These partisan positions are predictable but not held by the majority of Congress. Cooler heads offering careful consideration must be the rule, not the exception, or we will be dealing with a much bigger problem in the future. Members of Congress would be wise to review the Savings and Loan Crisis of the 1980s, when Congress’s response to the first crisis, over interest rates, contributed to a second even bigger crisis, over lending. The result cost taxpayers billions and changed the face of banking forever.