Earlier this year, most economists, political prognosticators, and the stock market expected inflation and interest rates to begin to come down and continue to moderate throughout the year. As recently as February, the Wall Street Journal reported that investors had been betting that the Federal Reserve Board’s Federal Open Market Committee (FOMC) would start cutting rates as early as its March meeting. It hasn’t happened. And with the May FOMC meeting behind us, and job growth still strong, the prospects of a Fed cut early this summer are slim.

At his press conference last week, Fed Chairman Jerome Powell was emphatic that the election would not be a factor in decisions about rates one way or the other. That’s the right thing to say, but the political blowback of cutting or not will not be deterred. He also said, “We don’t like to react to one or two months’ data.” The decision to leave rates where they are took into account the first quarter and Powell said, “The signal we’re taking [from the data] is it’s likely to take longer for us to gain confidence that we’re on a sustainable path to 2 percent inflation.” That’s a clear indication that a Q3 cut is unlikely. Regardless of what the FOMC decides, a modest July or September interest rate cut (they won’t meet in August or October) is unlikely to have any noticeable impact on the lives of most Americans. It will also be equally unlikely to change the political impact of this highly influential issue.

As I wrote two years ago, inflation has claimed more than its fair share of presidencies. President Gerald Ford declared that inflation was “public enemy number one” and led a campaign to “Whip Inflation Now,” featuring WIN buttons worn by supporters across the country. In his first joint address to Congress, he called on Americans “to help increase food and lower prices, grow more and waste less. To help save scarce fuel in the energy crisis, drive less, heat less.” It was a dismal failure. While his pardon of Richard Nixon devastated his approval ratings, voters at the polls were likely much more focused on eight percent inflation. George H.W. Bush had the opposite problem. Alan Greenspan’s FOMC dribbled out rate cuts during the 1992 recession, resulting in a 3rd quarter recovery that voters could not feel until the inauguration of Bill Clinton. In a remarkable interview with David Frost six years later, Bush blamed Alan Greenspan for his loss. Former President Bush said in a television interview that he blames Federal Reserve Chairman Alan Greenspan for his 1992 defeat. “I think that if the interest rates had been lowered more dramatically that I would have been re-elected president because the [economic] recovery that we were in would have been more visible,” he said.

For housing, this suggests mortgage rates may remain at or near 7% through the election, and the cost of building housing is unlikely to get any boost from the Fed. Congress already failed to enact meaningful housing supply legislation in April. High housing costs, and the inability of first-time homebuyers to participate in “the American Dream,” will continue to frustrate most Americans. And inflation, partly fed by high housing costs, will remain at levels unacceptable to the Fed, and most voters. Bill McBride’s housing affordability index tracks affordability since 1976. Affordability worsened slightly in February compared to January, as both mortgage rates and house prices increased.

Affordability today is the worst it has been in 40 years. And according to data from NHC’s Paycheck to Paycheck database, the salary needed to afford the same median priced home has nearly doubled since 2019, accounting for interest rates and home prices. While rent increases have slowed, they have not gone down. Whether you rent or own, your housing costs are a burden.

Unfortunately, while demand for affordable housing is high, interest rates also make it harder to build new housing, both for homebuyers and renters. The National Association of Home Builders (NAHB) recently reported that housing starts fell as interest rates remain high. Higher supply-side costs and tighter lending conditions are also contributing to the trend. “Builders are grappling on several fronts as the inflation fight continues,” said Carl Harris, NAHB’s chairman. “Higher interest rates are increasing the cost of housing for prospective home buyers and raising the development and construction cost for builders of homes and apartments. At the same time, shelter inflation is rising faster than overall prices due to supply-side challenges.”

The politics of inflation is all about prices, and the problem with prices is that short of a severe recession, they don’t go down much once they have gone up. Oil prices and food commodities will move with markets, but gas stations and grocery stores will be much slower to adjust. That means that despite strong job growth and increased Gross National Product, people will feel like the economy is bad every time they go to the grocery store, pay rent, fill up their gas tank, and especially, try to buy a new home.

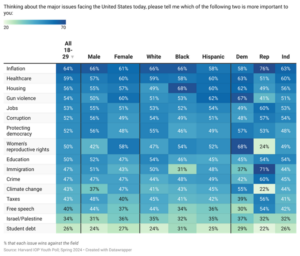

The best indication of how bad inflation hurts the incumbent political party, especially the president, is a recent poll of young voters conducted by the Institute of Politics (IOP) at Harvard Kennedy School that found inflation was the most important of 16 issues. Student loan debt and the war in Gaza were at the bottom of the list. At the top, inflation was followed by healthcare and housing.

Inflation narrowly beat immigration as the top issue for Republicans, edged out healthcare for independents and still came in the top five for Democrats where women’s reproductive rights and gun violence significantly beat all the others. Once again, in nearly every demographic group, Israel/Palestine and student debt were at or near the bottom.

Inflation’s impact on elections is one-sided. The incumbent president is always blamed for inflation and a bad economy, while the challenger can run on his or her plan to fix a pre-existing problem. It isn’t always fair, but it is always true. This is compounded by the fact that every voter experiences inflation personally. Unemployment, however, is only felt by the unemployed. Strong job numbers, like we have seen all year, don’t help President Biden, while inflation hurts him. And all the factors that contribute to this boil in a cauldron like a witch’s brew. Supply, demand, interest rates, affordability – especially for young professionals, all bubble with toil and trouble. As you may recall, the Scottish play ends well for no one.

The election is still six months away, and anything can happen between now and then. President Biden and former President Trump have a lot to say about what will happen, and we can be certain that they will. But inflation and interest rates will be a headwind that President Biden will have to navigate through, right up until November 5.