As the partial government shutdown crawls into its fourth week, anxiety among those housed with money from the unfunded Department of Housing and Urban Development continues to rise. This crisis is completely unnecessary and irresponsible. As I said in my note last week, no one wins in a government shutdown. Yet our “leaders” continue to negotiate by tweet and sound bite. On Tuesday, I appeared on FOX Business News and made this point with Neil Cavuto. Affordable housing advocates need to be careful to provide vitally needed facts to our constituents and avoid unnecessarily stoking the fears of innocent low-income people, especially the thousands of senior citizens and people with disabilities living in Section 202 and 811 units.

Our must vulnerable constituents are understandably terrified that they will be put out on the street in the middle of winter and we do not need to add to their anxiety. Media reports often antagonize these fears, and some have sought to leverage them on behalf of a broader political agenda. NHC is in touch with senior officers at HUD on a regular basis to ascertain what is being done to address this unprecedented crisis in government and political leadership. There are also 800,000 federal government employees who are furloughed or working without pay who will have to make their first rent or mortgage payment without a paycheck on Feb. 1 – two weeks from now. Every day the stalemate continues, pressure increases on both the White House and Congress to reach a settlement, so there is no guarantee that the government will still be shut down in February, but we are in uncharted water and anything is possible.

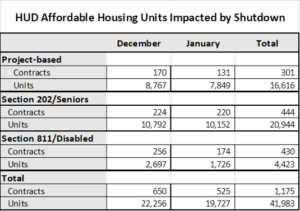

Here’s what we know. There are 1,175 rental contracts that have not been renewed due to the shutdown, impacting 41,980 units – and about half of these are occupied by low-income seniors. A complete breakdown of these numbers is included in the chart below. None of these residents are currently at risk of being evicted. Not one. This could change if the crisis extends past February, but it is not the case for at least several more weeks. HUD has staff throughout the country working with landlords to ensure this does not happen. Contracts are being paid with available funds, and landlords are being told to use their reserves to cover operating expenses. Should the crisis drag on into February, another 500 contracts will be impacted, and drawing down reserves will be more common. It is a stressful time for landlords including many of our members who are struggling to deal with the many uncertainties. All landlords of Section 8 and other federally-funded tenants should refer to this important memo, which outline activities that will continue to take place during the first 30 business days of the shutdown and contact their Asset Management Division Director representative with any issues.

It is also important to note federal workers and contractors are not at risk of foreclosure due to failure to pay their mortgages during the shutdown. All workers and contractors are urged to call their mortgage servicer. Government employees and contractors aren’t going to face their first payment without a paycheck until Feb. 1. FHA, Fannie Mae and Freddie Mac have told their mortgage servicers to treat these homeowners like victims of a natural disaster.

NHC strongly recommends that if the crisis drags on another two weeks, federal employees should call their servicer on Feb. 1 if they are going to miss a payment. Servicers have also been instructed not to report these late payments to credit reporting bureaus, but homeowners should also check with the three credit reporting agencies in March to ensure that this request has been honored. Federal employees and contractors who rent, however, are not covered by these policies. They should also contact their landlord on Feb. 1 – in writing – to request forbearance during the crisis. Only the worst landlords will threaten eviction and it is highly unlikely that they will go through the expense of an eviction procedure over a late payment due to a national crisis. Communication is critical.

Homebuyers shopping for a new home this winter may be concerned about the availability of FHA mortgages. I have been told by FHA’s senior leadership that FHA endorsements on single family mortgages are being made. However, endorsements on new FHA multifamily closings are being delayed.

NHC will continue to closely monitor the situation and share resources accordingly.