Last weekend, the Wall Street Journal wrote a scathing editorial alleging that “a new rule will raise mortgage fees for borrowers with good credit to subsidize higher-risk borrowers.” The truth is no one with the same credit score will pay more for making a larger downpayment, and no one with the same downpayment will pay more for having a better credit score. Those with good credit scores will not be subsidizing those with worse credit scores.

The problem is that most people don’t read mortgage pricing grids. What started as an ill-informed debate on an overly complicated mortgage policy was turned into a cynical way to draw homeownership into the “culture wars.” It won’t work. So, let’s take a careful look at the details and explain what happened, what is being done, and what we need to do to be sure that everyone is treated fairly when it comes to how much it costs to get a mortgage.

What was alleged

The Journal claimed that “under the rule, which goes into effect May 1, home buyers with a good credit score over 680 will pay about $40 more each month on a $400,000 loan. Those who make down payments of 20% on their homes will pay the highest fees. Those payments will then be used to subsidize higher-risk borrowers through lower fees.” Their conclusion was that this is a “socialization of risk” that “flies against every rational economic model, while encouraging housing market dysfunction and putting taxpayers at risk for higher default rates.” This is simply not true. The taxpayers are not at any higher risk, and neither are homebuyers, lenders, or anyone else. The allegations look at one aspect of a complex equation that charges more for some people with higher downpayments – which it shouldn’t – but it is wiped out by other parts of the equation.

Dave Stevens, a former president of the Mortgage Bankers Association and FHA Commissioner during the Obama Administration wrote about the new pricing grids in an op-ed in Housing Wire on February 6, just a couple of weeks after the new grids were made public. It’s pretty deep in the weeds, and not a lot of people noticed it (including me). He suggested that this was an effort to “push the GSEs to provide better execution for first-time homebuyers with lower [credit] scores, many of whom will be minority borrowers, [as] has been called for by civil rights and consumer activists for years.” The GSEs are the Government-Sponsored Enterprises Fannie Mae and Freddie Mac. The grids are Loan Level Price Adjustments (LLPAs) charged on some GSE loans as an extra fee to protect against credit risk traditionally covered by mortgage insurance, required on GSE loans with down payments under 20%.

The issue was picked up by the New York Post on April 16, with the headline “How the US is subsidizing high-risk homebuyers — at the cost of those with good credit.” It didn’t take long for FOX Business News to pick up the story a few days after that, where Stevens said he had just received an email from a lender who said, “so I guess we have to teach borrowers to worsen their credit before they apply for a loan.” It’s a clever talking point. It just happens to be completely wrong, but perfect for three news outlets owned by Rupert Murdoch.

By the time the Wall Street Journal wrote its editorial, the narrative was everywhere, including Newsweek, Members of Congress on both sides of the aisle were getting calls from their constituents who were outraged. It got worse on CNBC when anchor Becky Quick started the interview by saying borrowers with good credit scores would pay higher fees “while riskier buyers will get more favorable terms.” Stevens doubled down, saying that low-credit quality borrowers are “cross-subsidized by borrowers with higher credit scores and higher downpayments.” Operation Hope president and founder John Hope Bryant correctly said it’s “not really about credit scores,” which is true, and then said the allegation was “technically correct,” which it is not. On Tuesday, Housing Financial Services Chairman Patrick McHenry (R-N.C.) and Housing and Insurance Subcommittee Chairman Warren Davidson (R-Ohio) wrote to FHFA Director Sandra Thompson, insisting that she repeal the LLPA changes. The issue also came up at a hearing of the Senate Banking, Housing and Urban Affairs Committee.

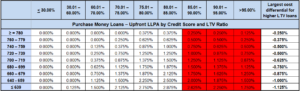

So how did they all get it so wrong? Because risk-based pricing grids are ridiculously complicated, and even a mortgage expert like Stevens and a highly respected journalist like Quick can misread them, as you can see in the chart below. The red boxes are LLPAs that are lower for people with lower down payments than those charged for people who put more than 20% down with the same credit score. I agree with Stevens that this aspect is not fair, but it’s still a minute charge, as the column on the right makes clear. This shows the largest cost differential between the >20% down payments and the <5% down payments. This is clear if you carefully read the grid horizontally for each credit score cohort. If you read the grid down, it’s also clear that for each downpayment cohort, no one pays more for having a lower credit score. No one.

By Tuesday night, Director Thompson issued a statement, making clear that “much of what has been reported advances a fundamental misunderstanding about the fees charged by the Enterprises, and why they were updated.” She went on to explain that the GSEs’ Congressional charters “specifically include references to supporting low- and moderate-income families by earning returns on mortgages for these borrowers that may be less than the returns earned on other products. Indeed, Congress incorporated this into the Enterprises’ charters decades ago and it is a long-standing component of the Enterprises’ core business models.” She also wrote a letter to the Editor at the Wall Street Journal, where she said “your editorial fails to recognize that modestly higher fees will enhance Fannie and Freddie’s safety and soundness, which will benefit taxpayers. And targeted fee eliminations based on income, not credit score, are primarily supported by higher fees on loans for second homes, investment properties and cash-out refinancings.”

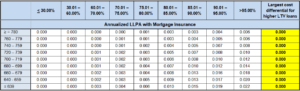

Urban Institute also published a blog by former Obama administration White House staffer Jim Parrott, arguing that “the criticism is misplaced, conflating two separate, largely unrelated moves on pricing…” As Parrott makes clear in a second blog co-written by Janneke Ratcliffe, when factoring in mortgage insurance rates, which everyone with less than a 20% downpayment has to pay when they get a GSE loan, no one pays more for making a larger downpayment. This grid combines the total monthly fee the borrower actually pays.

These are all people I like and respect. How did so many of them get it so wrong? It’s easy, because loan level price adjustments that cross-subsidize risk in any direction are notoriously complicated. These fees never existed before 2008 when they were designed to increase payments to the Treasury Department, cover losses during a time when the GSEs were still bleeding cash as a result of the terms of their conservatorship, offset the protection historically afforded by mortgage insurance at a time when the mortgage insurance industry was in an existential crisis, and discourage all but the most pristine borrowers from becoming homeowners. None of these conditions exist today. Since then, LLPAs have morphed into a tool to build the GSEs’ capital accounts so they can someday be removed from government conservatorship, largely at the expense of those homebuyers who can least afford it.

What should be done

In an effort to make these highly complex and outdated fees more fair and relevant, they have become twisted out of alignment of any relation to risk-based pricing, as higher prices are, in fact being charged for less risky mortgages. While the amount to be charged is nominal and is offset by the cost of mortgage insurance, the principle is still just as twisted.

It’s clear that LLPAs and risk-based pricing have outlived their usefulness. The mortgage insurance industry is healthy and better regulated than ever, credit standards for all borrowers still far exceed those that predated the financial crisis of 2008, and GSE guarantee fees remain the appropriate place for investors to pay for the guarantee on the timely payment of principal and interest on the mortgage-backed securities that make this market so liquid and efficient. If we want a fair deal for first-time homebuyers of all incomes, then we should charge everyone the same rate, as we have for over 80 years, and as FHA still does today.