Photo source: Davis, Bingham, Hudson & Buckner, PC

Photo source: Davis, Bingham, Hudson & Buckner, PC

The housing crisis of 2021 is a double edged sword. Homeownership is too expensive nearly everywhere. But in some places, the cost of owning a home is actually too cheap. It’s a bizarre situation that leaves too many people at nearly every income level shut out of the American Dream of homeownership.

The problem getting the most attention is high housing prices, principally caused by an imbalance of supply and demand. We simply are not building enough homes that are affordable to first-time homebuyers and those move-up buyers looking for more space.

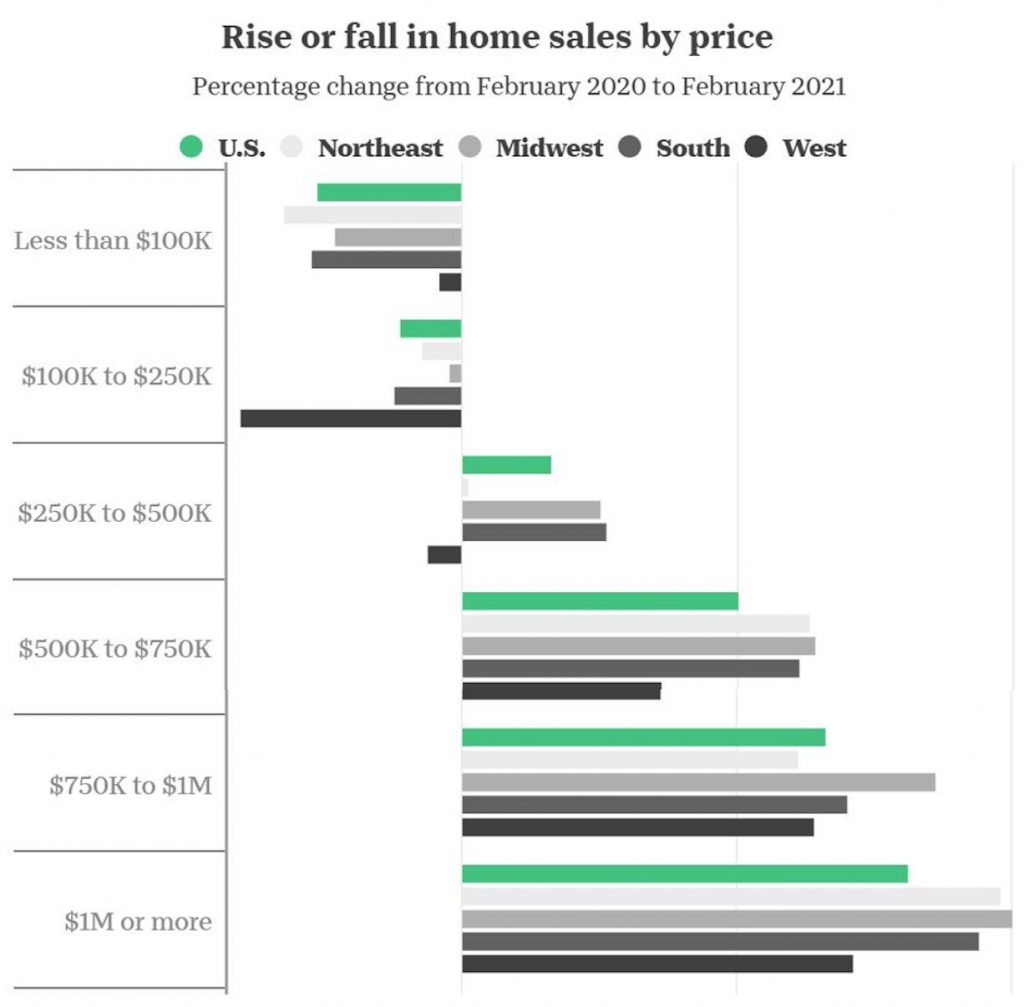

Lack of affordable homeownership opportunities was already a problem before the pandemic, but it has significantly worsened in the past year as housing supply has fallen, labor has become scarcer, and lumber costs have soared. The National Association of REALTORS® (NAR) reports that the median existing-home sales price in March rose at a record-breaking pace of 17.2% annually to a historic high of $329,100. Every region NAR studied saw double-digit price gains. By the end of the first quarter, housing inventory was down by 28.2% year-over-year. Properties typically sold within 18 days, the quickest pace on record. Inventory will remain tight as even more buyers enter the market.

Cash offers increasingly dominate the market and crowd out first-time homebuyers, as I discussed on FOX Business News recently. Many sellers take cash even if it isn’t the highest offer. Reasons for this include cash buyers’ willingness to waive home appraisals, inspections and contingencies on mortgage approval.

But there is another edge to the homeownership crisis – home prices that are too low. In many communities across the country, especially in rural areas, the cost of renovating or building homes exceeds the appraised value of the home after construction. This “appraisal gap” prevents first-time homebuyers from getting mortgages that are affordable to them. Instead, many of these homes are bought for cash by investors and turned into rental units. Some become abandoned and blighted, further depressing neighborhood home values.

The Neighborhood Homes Investment Act (NHIA) creates a tax credit allocated by the states that would cover the gap between the cost of construction and the sales price of the home. It is modeled on the Low Income Housing Tax Credit (LIHTC), which also is allocated by the states and has a 30-year track record of spurring the construction of affordable apartments.

As with the LIHTC, private investors would bear market and construction risks, and the credits would only be awarded when the homes are sold to qualified homebuyers. This bipartisan legislation would contribute to closing the homeownership gap for people of color, increasing the supply of affordable housing by allowing especially first-time homebuyers to take advantage of the market’s historically low interest rates.

The nation’s housing challenges are complicated, as the too-expensive-too-cheap conundrum helps illustrate. But there are solutions. NHC has endorsed several pieces of legislation to address the range threats to housing affordability, including the Restoring Communities Left Behind Act, the Yes in My Backyard Act, the Housing Supply and Affordability Act, and the Build More Housing Near Transit Act, as well as the NHIA.

Our task is to work together to shape the right solutions and make them realities.