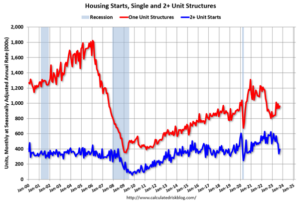

Housing has never been so expensive – for homeowners and renters, at all income levels, in every part of the country. This we know. We also know how to make housing more affordable – build more affordable housing. It’s not rocket science, but it’s also not a quick and easy solution. A deficit of 3-5 million housing units, depending on how we account for it, could take 10-15 years to close. We dug this hole over 15 years. We are going to have to get out of it the same way. One shovel at a time. Delay, however, ensures it will take longer, and be more costly.

The impact of this production deficit on affordability is devastating for first-time homebuyers and has all but eliminated the move-up market. The income necessary to afford the same median-priced home has doubled from $66,710 in August 2019 to $126,420 in August 2023.

Source: National Housing Conference

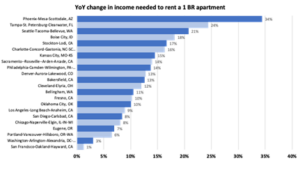

While rents have begun to stabilize, the huge increases experienced since the pandemic are baked into the unaffordable housing pie. According to NHC’s Paycheck to Paycheck database, the income needed to rent a one-bedroom apartment in Phoenix, Ariz., is up 34%. In Tampa, Fla., it’s up 24%. Even Boise, Idaho, requires an 18% increase in salary to afford the same one-bedroom apartment. Not coincidentally, Phoenix also saw one of the nation’s largest increases in homelessness. Homelessness across the country increased by 12.5% between 2020 and 2023, yet Arizona saw a 30% jump in its homeless population during that same period. Arizona was one of just four states where more than two-thirds of unaccompanied youth under age 25 did not have a place to sleep. “We can have all the money we could possibly use… if we don’t have the units to actually house people, that money is basically worthless,” Tom Simplot, Director, Arizona Department of Housing, told the Arizona Republic.

Source: NHC Paycheck to Paycheck Database, 2022-2023 data

A major step towards closing the rental housing gap has already been approved by the House of Representatives. The Tax Relief for American Families and Workers Act includes major provisions from the Affordable Housing Credit Improvement Act, which will create 200,000 additional units of affordable rental housing. The bill passed 357 to 70 after a 40-3 vote in the House Ways and Means Committee. That’s a huge accomplishment. Think about all the dysfunction we have witnessed in Congress. Yet, Democrats and Republicans joined together to support the new tax bill.

Housing production is the foundation of the housing affordability crisis, but it is not the only factor. The bill will also extend the Child Tax Credit (CTC) as well as several business tax deductions. These provisions will also help address the housing affordability crisis, boosting the incomes of those most in need while helping create new private-sector jobs. The National Low Income Housing Coalition estimates that 7 million Americans struggle with paying rent, and the CTC and Low-Income Housing Tax Credit expansion will help with that, both directly and indirectly.

Administratively, we can also make existing support for affordable housing by reforming the Section 8 housing program, streamlining the HOME program, and simplifying the Capital Magnet Fund (CMF). We continue to await these efforts from the Biden Administration, long overdue. Better incentives for the Low-Income Housing Tax Credit to supply housing for extremely low-income renters, who are closest to homelessness, are also on our agenda. We are pretty good at getting people out of homelessness, but we are terrible at closing the pipeline into homelessness. The “ELI basis boost,” as it is known, will help.

Affordable first-time homeownership is also a major crisis, most severely for first-generation homebuyers, who are disproportionately people of color. The Neighborhood Homes Investment Act is an important part of any affordable homeownership strategy, as is better downpayment assistance, including private sector Employer Assisted Housing programs and Section 8 for Homeownership reform. The CMF could also be directed to better support affordable homeownership.

We have a major affordable housing crisis in America, making the American Dream a dream deferred for too many of us. But it is not unsolvable if we have the political will and are willing to work together, like the House did last month. The first step is for the Senate to pass the bipartisan tax bill. Regulatory reform is almost as important. Only by taking action on these well-established approaches will we begin to close the housing affordability gap.