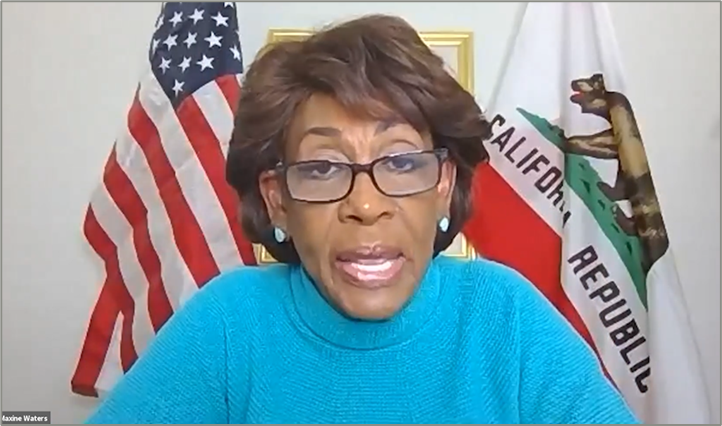

This week, NHC was proud to host Financial Services Committee Chairwoman Maxine Waters at our 90th Annual Member Meeting. Chairwoman Waters was generous in recognizing “the role NHC has played during the pandemic” to “fight to ensure families remain safely and stably housed,” she said, adding that “we need all hands on deck” for the hard work ahead. Addressing the importance of the nearly $10 billion Homeowners Assistance Fund as well as $45 billion in emergency rental assistance, Chairwoman Waters said that the work of NHC and members of the Black Homeownership Collaborative was “critical to the efforts to gain support for these critical resources.”

Chairwoman Waters also discussed her legislation to address the racial wealth and homeownership gaps. “The Down Payment Toward Equity Act… targets up to $25,000 in down payment grants for first time, first generation homebuyers who, unlike their peers, do not have access to generational or family wealth. This bill will be a major step towards delivery on racial and economic justice for millions of first generation homebuyers who are disproportionately Black and brown,” she said.

Later, during our National Advisory Council meeting, we were joined by Deputy Assistant Secretary of the Treasury for Community Economic Development Noel Andrés Poyo, who talked about efforts by the Biden Administration to get Emergency Rental Assistance and Homeowner Assistance Fund money into the hands of those who need it most, as quickly as possible.

Addressing criticism by some that the “money isn’t flowing,” he noted that two multi-billion programs had to be created from the ground up. “I understand why the front page story on ERA is that the money isn’t flowing, since nobody wants to hear about construction the plumbing that can get these things out to people, they just want the money to flow,” he said, adding that “I’m hopeful that the story we’ll be able to tell at the end of this is that ERA delivery would have been better had we had the infrastructure ready to go, but that public servants across this country nonetheless built out that infrastructure while delivering assistance to those in need, thus laying the foundation for delivery during the next crisis.”

NAC member Susan Dewey, who runs Virginia’s housing finance authority, Virginia Housing, agreed that “it’s difficult to overstate the challenge of the task we’re being given. We’re trying to build new programs from scratch, and we need to give each other grace in this process.” Poyo noted that Virginia has set the national standard under Dewey’s leadership.

Immediate Past NHC Board Chair Linda Mandolini, president and CEO of Eden Housing, which serves more than 22,000 low-income residents in affordable rental apartments throughout California, catalogued some of the challenges she faces in her state, including a complex web of programs in multiple jurisdictions, each with their own documents and restrictions. Eden has had to develop an entire team of employees to staff the initiative, not possible for smaller organizations. She suggested that “it would be helpful if landlords of income-restricted housing could certify our restrictions with the relevant housing finance agency and apply in bulk on behalf of our clients.” Poyo said the latest round of FAQs inferred that this was an option, but the statute requires tenant involvement. Nonetheless, bulk applications should be possible.

Poyo’s discussion was followed by a panel discussion led by Barry Zigas with Jung Choi from the Urban Institute, Nat Decker from Terner Center for Housing Innovation, and Noerena Limon from the National Association of Real Estate Professionals on the impact the pandemic has had on small landlords and how rental assistance has played out on the ground. This discussion was followed by another panel discussion led by Jackie O’Garrow with Julia Gordon from the National Community Stabilization Trust, Buzz Roberts from National Association of Affordable Housing Lenders, and Yonah Freemark from Urban Institute on the rise of cash buyers. NHC is grateful to the panelists for their timely and thought-provoking presentations and for the rich discussion that followed. NHC is especially appreciative of our NAC co-chairs Jackie O’Garrow and Barry Zigas, who have led the NAC for the past two years and will turn their responsibilities over to new co-chairs next week.

NHC is fortunate to have members with such deep experience and leadership.