In 1964, four years before the signing of the Fair Housing Act, Dr. Martin Luther King Jr. wrote the book entitled, “Why We Can’t Wait.” In the book, he highlighted the need to address the issues that impacted the black community. “We are caught in an inescapable network of mutuality, tied in a single garment of destiny,” he wrote. “Whatever affects one directly, affects all indirectly.” These words are a guide to our work and advocacy at NHC, as we continue to elevate the conversation around the decline in black homeownership to focusing on solutions that are tangible, actionable and impactful.

The generational wealth of the black community that started during the Civil Rights Era has seen a dramatic decline within the last decade. White millennials with the same level of education, same level of income and same career path continue to outnumber their black counterparts in building generational wealth. This can be attributed to a wide range of issues, including access to mortgages, homeownership education and family financial support. The millennial generation also tends to delay household formation longer than previous generations, shortening the time window that many Black millennials have to build wealth.

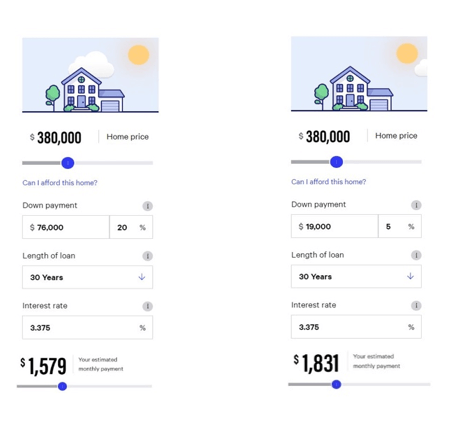

At NHC, we are not waiting. We have brought together research, advocacy and industry leaders to the table to find a way to help close the homeownership gap. One of the things we have learned is that first time homebuyers have an inaccurate belief that a down payment of 20 percent is required to buy a home. In fact, down payments can be low as 3 percent.

Unfortunately, this perception is encouraged by the fact that nearly every online mortgage calculator defaults the down payment to 20 percent. While this reduces the size of the monthly payment by a few hundred dollars, it dramatically increases the money required upfront – the largest barrier for a first-time home buyer. As can be seen in these screen shots from Bankrate.com, for a $380,000 mortgage, the monthly payment is only $250 higher with a 5 percent down payment, but the down payment required is an additional $57,000. Saving that much money at $250 per month would take more than 16 years. NHC is working with our members to change mortgage calculators so they don’t start with 20 percent.

Another area of concern is that the housing goals for Fannie Mae and Freddie Mac don’t track actual performance in first time homebuyers and homeownership by race. We believe that any successful effort to close the minority homeownership gap depends on good data and clear goals. Recently, FHFA Director Mark Calabria said that he will take a fresh look at the affordable housing goals. We believe that increasing homeownership for first time homebuyers and closing the minority homeownership gap must be a part of any new Duty to Serve rule, ensuring that those words mean exactly what they say.

As Dr. King said, we can’t wait. We know this problem will not fix itself and requires a broad coalition of members coming together to increase black homeownership and level the playing field for the next generation. At NHC, it is what we and our members do every day.