Back in 2005, I was deeply concerned about the housing bubble and the potential for a financial crisis. This note discusses a key difference between the 2005 housing market and the current market.

A year ago, I wrote The Housing Bubble and Mortgage Debt as a Percent of GDP. Here is an update to a couple of graphs. The bottom line remains the same: There will not be cascading price declines in this cycle due to distressed sales.

In a 2005 post, I included a graph of household mortgage debt as a percent of GDP. Several readers asked if I could update the graph.

First, from February 2005 (19 years ago!):

The following chart shows household mortgage debt as a % of GDP. Although mortgage debt has been increasing for years, the last four years have seen a tremendous increase in debt. Last year alone mortgage debt increased close to $800 Billion – almost 7% of GDP.

Many homeowners have refinanced their homes, in essence using their homes as an ATM.

It wouldn’t take a RE bust to impact the general economy. Just a slowdown in both volume (to impact employment) and in prices (to slow down borrowing) might push the general economy into recession. An actual bust, especially with all of the extensive sub-prime lending, might cause a serious problem.

And a serious problem is what happened!

The second graph shows household mortgage debt as a percent of GDP through Q3 2023 (based on the Fed’s Flow of Funds report).

The “bubble” is pretty obvious on this graph, and the sharp increase in mortgage debt was one of the warning signs.

The blip up in Q2 2020 was related to the collapse in GDP rather than an increase in mortgage debt. With the recent house price increases, some people are worried about a new housing bubble – but mortgage debt isn’t a concern and lending standards are much better now than during the bubble.

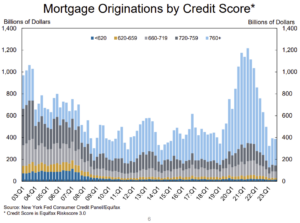

The third graph, from the NY Fed’s Quarterly Report on Household Debt and Credit on mortgage originations by credit scores is one indicator that lending has been reasonably solid.

From the NY Fed:

Credit quality of newly originated loans was steady, with 4% of mortgages and 16% of auto loans originated to borrowers with credit scores under 620. The median credit score for newly originated mortgages was flat at 770 …

The bottom line is there will not be a huge wave of distressed sales as happened following the housing bubble. Most homeowners have significant equity, were well qualified, and have a mortgage with low rates that they can afford.

The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.