The U.S. Treasury’s Emergency Rental Assistance (ERA) program provides $25 billion to state and local governments to assist households unable to pay rent and/or utilities due to the ongoing COVID-19 pandemic. With various funding sources, eligibility criteria, and changing federal guidance, states and local governments are overwhelmed with quickly administering this program while remaining compliant with regulations. As a result, many jurisdictions are turning to advisory firms such as CohnReznick LLP to administer and monitor their ERA program.

Technology and compliance are key to administering ERA funds

In order to expedite rent relief to individuals and families in need, state and local agencies are using technology solutions to accept and process applications and pay claims. However, speed and technology are not all that is needed to facilitate a successful ERA program. Protecting stakeholder interests and ensuring compliance with changing regulations are also crucial to success.

According to Amanda Campen, sr. manager of CohnReznick Government Advisory, “Government entities that are distributing ERA funds have very unique needs and require an end-to-end program management solution that addresses all aspects of a citizen-centric program from verifying applicant eligibility to maintaining compliance with changing regulations. At CohnReznick, we’re utilizing technology solutions to optimize ERA performance while protecting the public trust through our compliance, monitoring and oversight capabilities. Additionally, CohnReznick has both world-class affordable housing insight and an extensive track record of providing large-scale program management and emergency management services for federal, state, and local governments to ensure successful deployment of ERA funding.”

ERA grantees must avoid pitfalls

Even the best-constructed ERA programs can run into obstacles to distributing funds to qualified tenants in a timely manner. CohnReznick recommends that state and local governments should watch out for 10 common pitfalls related to operations, compliance, vendors and more. To learn about these pitfalls and our tips for overcoming them, please see our article here.

The Housing Assistance Fund: The next generation of housing assistance

Treasury’s Homeowner Assistance Fund (HAF) is the cutting edge of housing assistance coming out of the pandemic. Established under the American Rescue Plan Act of 2021, HAF provides up to $9.961 billion for states, the District of Columbia, U.S. territories, Tribes or Tribal entities, and the Department of Hawaiian Home Lands to provide relief for our country’s most vulnerable homeowners. The purpose of the program is to prevent mortgage delinquencies and defaults, foreclosures, loss of utilities or home energy services, and displacement of homeowners experiencing financial hardship after Jan. 21, 2020.

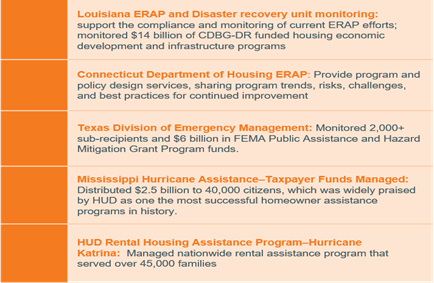

Like ERA programs, HAF programs can provide much-needed assistance, but are complex enough to require end-to-end program management technology solutions from a provider experienced in speeding funding, ensuring compliance, and protecting the public trust while avoiding pitfalls. CohnReznick’s Government Advisory Team provides these technology and management solutions to our state and local government clients. We hope you will consider contacting us should you need a trusted advisory to help you with your housing assistance program. CohnReznick’s extensive experience includes the following:

For more information about how CohnReznick can assist you with ERA and HAF programs, please contact:

Frank Banda, CPA, CFE, CGMA, PMP

Managing Partner—Public Sector

CohnReznick LLP

Tel: 301-280-1856

Frank.Banda@CohnReznick.com