I’ve been wrestling with the impact on house prices of the rapid increase in mortgage rates and monthly payments over the last year. My reaction was the current situation was somewhat similar to the 1978 to 1982 period and we would see prices decline in real terms (adjusted for inflation). See from March 2022: Housing: Don’t Compare the Current Housing Boom to the Bubble and Bust.

In that article I wrote on prices:

In the 1980 period, nominal prices only declined slightly on a month-to-month basis a few times according to the Case-Shiller National house price index. However, real prices – adjusted for inflation – declined 10.7% from the peak. The inflation-adjusted peak was in October 1979, and real prices didn’t exceed that peak until May 1986 (See from October 2022: House Prices: 7 Years in Purgatory).

Note that if we use the Freddie Mac House Price Index, nominal prices declined 6.9% in the early 1980s, and real prices declined 17.5%!

As I noted in “7 Years in Purgatory”:

“Earlier this year, I argued the most likely path for house prices was for nominal prices to “stall”, and for real prices (inflation adjusted) to decline over several years. The arguments for a stall included historically low inventory levels, mostly solid lending over the last decade, and that house prices tend to be sticky downwards. … However, we are already seeing nominal house price declines on a national basis.”

And the historically low level of inventory is a key reason house prices haven’t declined more to date. As of February, the Case-Shiller National Index was off 2.8% in nominal terms (seasonally adjusted), and off 4.6% in real terms.

Here is a look at the house price battle between low inventory and affordability.

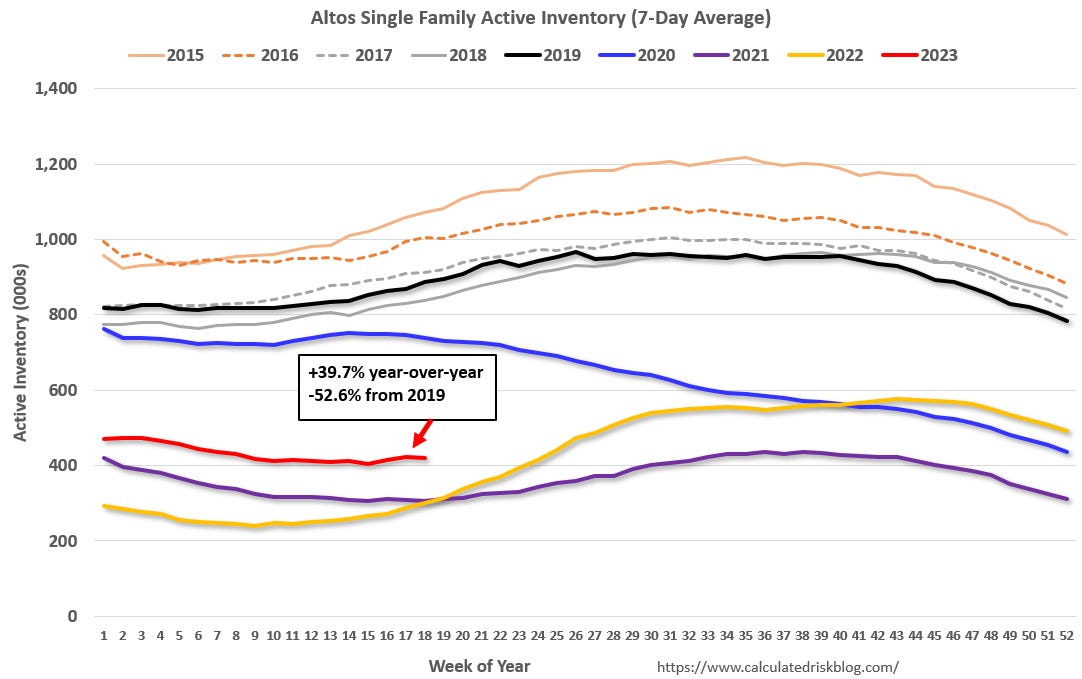

The following graph is based on data from Altos Research showing active single family home inventory over the last 9 years through May 5th. Inventory collapsed in 2020 due to a combination of factors: supply was restricted since many homeowners didn’t want strangers in their homes, and demand picked up significantly as mortgage rates fell sharply at the beginning of the pandemic. Also, investor buying increased significantly, and demographics were favorable for homebuying.

Inventory fell further in 2021 and then picked up in the 2nd half of 2022 as mortgage rates increased. With record low levels of inventory in late 20202, 2021 and early 2022, house prices soared with the Case-Shiller index up over 19% in 2021 alone.

Currently inventory is above the levels in 2021 and 2022, but well below normal levels. And it seems likely that inventory will be down year-over-year in a few months!

The next graph that shows existing home months-of-supply, inverted, from the National Association of Realtors® (NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through January 2023). Note that the months-of-supply is not seasonally adjusted. The last ten months are in black showing a shift in the relationship, and prices have fallen with low levels of inventory!

Months-of-inventory has averaged 3.0 months over the last 10 months. Historically that would mean prices would be rising quickly – around 1.2% per month seasonally adjusted, or about 12.5% over the last 10 months. However, prices have fallen 2.5% over the that period.

So, just looking at inventory, nominal prices are about 15% below what we’d expect!

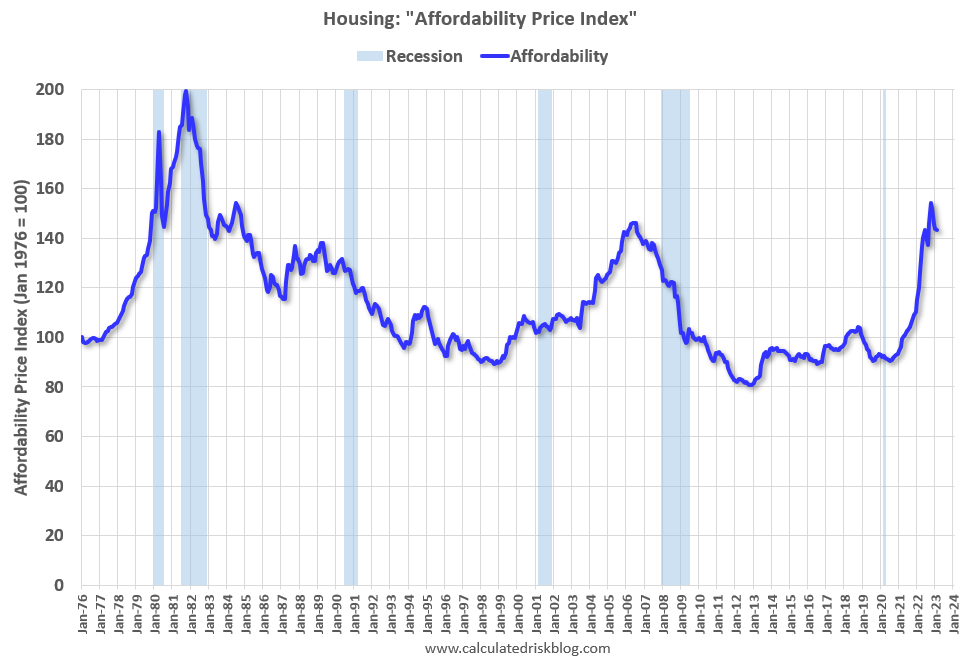

The key reason that prices have fallen with these levels of inventory is the increase in mortgage rates and monthly payments. Here is a graph of my affordability index (lower is more affordable):

Note that by this index, during the early ‘80s, homes were very unaffordable due to the very high mortgage rates. During the housing bubble, houses were at about the same level of unaffordability using 30-year mortgage rates, however, during the bubble, there were many “affordability products” that allowed borrowers to be qualified at the teaser rate (usually around 1%) that made houses seem more affordable.

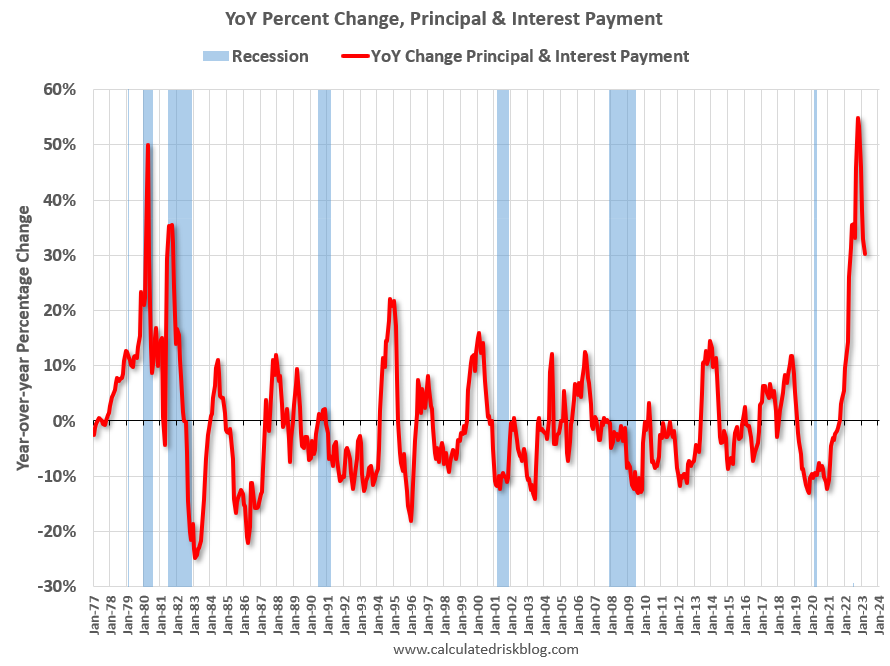

Really it is the change in monthly payments that impacts housing. Monthly payments include principal, interest, taxes, insurance (PITI), and sometimes HOA fees (Homeowners Association). We could also include maintenance, utilities and other costs.

The following graph shows the year-over-year change in principal & interest (P&I) assuming a fixed loan amount since 1977. Currently P&I is up about 30% year-over-year for a fixed amount (this doesn’t take into account the change in house prices). This is similar to the change in monthly payments in 1980!

If we include the increase in house price increases, the monthly payment – for the same house – is up 90% over the last two years. That increase in monthly payments is pushing down house prices.

The Battle will Continue

Inventory is pushing up prices, and affordability (the change in monthly payments) is pushing down prices. And it appears this battle will continue.

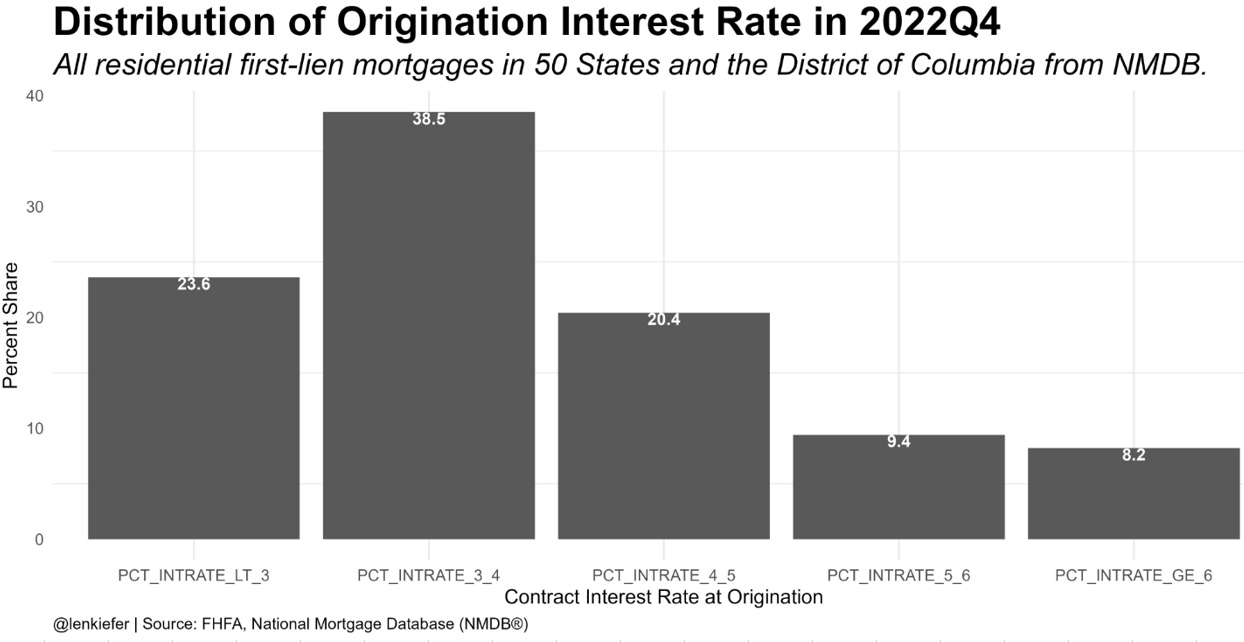

Economist Len Kiefer recently pointed out that “having nearly 2 out of 3 mortgages with a rate of 4% or less and market rates over 6% isn’t going to help with the inventory situation”. Here is a graph from Kiefer of the distribution of mortgage interest rates. This doesn’t include homeowners without a mortgage.

This shows that 62.1% of mortgages are under 4%, and 82.5% are under 5%. If these homeowners move, their monthly payments will increase substantially.

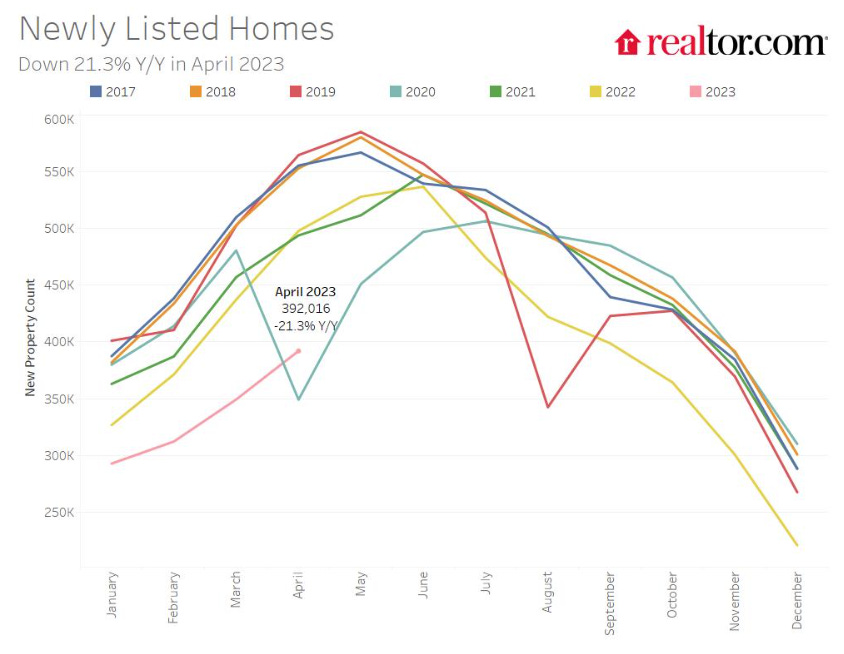

This is why new listings are down over 20% year-over-year. This graph from Realtor.com shows new listings by year:

My expectation is that we will see further declines in real house prices (and probably for nominal prices). But there is no relief in sight for inventory or for mortgage rates. So, the “House Price Battle Royale” between inventory and affordability will continue for now.

Bill McBride is the author and creator of the Calculated Risk Blog and is a periodic contributor to the NHC Member Brief.