The latest serious mortgage delinquency data released on Foreclosure-Response.org have a mix of good and bad news for homeowners and communities. The good news is that the overall serious mortgage delinquency rate (loans that are either 90+ days delinquent or in the foreclosure process) is showing signs of stabilizing. The bad news is that the rate is still quite high and the foreclosure rate itself is still on the rise. Taken together, these trends suggest that the foreclosure problem remains severe but the pipeline of troubled loans may be slowly shrinking. The evidence also suggests that loans may be lingering longer in the foreclosure inventory.

The data are from December 2010 and are updated quarterly.

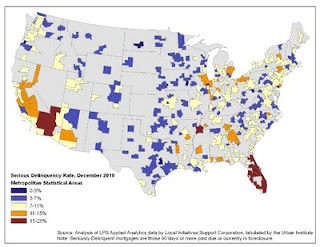

For Florida and much of the Southwest, there’s little sunshine in the data. Metropolitan areas in Florida and the southwestern United States continue to experience some of the highest rates of serious delinquency. Many Sun Belt cities had rates well above the average for the 100 largest metro areas. In the map below, at least 3 out of every 20 residential mortgages in the red metros—sometimes as many as 1-in-4—are more than 90 days past due or in foreclosure. This includes most of Florida, southern California, the Las Vegas area, the Memphis area, and parts of New Jersey and Illinois. The blue areas are doing much better, but may still be historically high.

How is your area faring? Better or worse than last year? Better or worse than other metropolitan areas nationwide? Check out Foreclosure-Response.org for the national rankings and data for all 366 U.S. metropolitan areas to find out. (Foreclosure-Response.org is a project of the Center for Housing Policy, Local Initiatives Support Corporation, and the Urban Institute.)