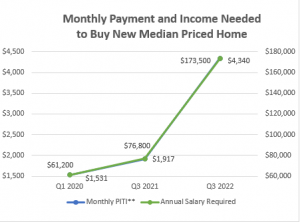

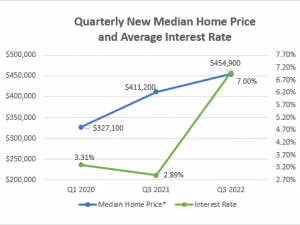

WASHINGTON DC – The income needed to buy a median-priced home in the United States has doubled since 2019 from $54,200 to $111,000, according to the National Housing Conference. For new homes, the income required has nearly tripled, from $61,200 to $173,000.

“While the Federal Reserve’s interest rate hikes are beginning to reduce prices, the actual cost of housing remains at historic highs due to the impact of skyrocketing mortgage interest rates,” said David M. Dworkin, President and CEO of the National Housing Conference. “As interest rates continue to rise, fewer homes are being built and fewer homeowners are putting their homes on the market for sale,” Dworkin said. “The law of supply and demand cannot be repealed. As long as our supply cannot meet demand, housing will remain unaffordable, and inflation will resist efforts to yield to rising interest rates,” Dworkin said.

“The home affordability crisis is no longer an issue reserved for coastal cities. It is impacting homebuyers throughout the U.S.,” Dworkin said. According to the most recent update of NHC’s Paycheck to Paycheck database, a pharmacy technician cannot afford to buy a home or rent a two-bedroom apartment in St Louis, MO, Tucson, AZ, or Fayetteville, NC. The average police officer in Fayetteville, NC makes $47,310 and the average salary needed to buy a home is $65,310. The Paycheck to Paycheck database enables users to evaluate the affordability of a range of rental and homeownership opportunities for 147 occupations in 390 markets. NHC updates the data quarterly.

Fewer than 6 percent of new homes sold in the U.S. were priced under $300,000 in September 2022. This number is down from around 80 percent in 2002, according to Bill McBride’s Calculated Risk Blog

“Ultimately, our housing affordability crisis, and inflation, will only be addressed by an increase in the production of affordable housing for ownership and for rent,” Dworkin said. “Congress must pass incentives to build more affordable housing before the end of the year.” This includes bipartisan legislation like the Neighborhood Homes Investment Act and the Affordable Housing Credit Improvement Act, which together would create 2.5 million homes over ten years. Both of these bills are supported by the National Housing Conference, the Bipartisan Policy Center, and a host of other housing organizations across the ideological spectrum.

Methodology: Estimates are based on data from the National Association of REALTORS® Existing Home Sales data, New Home Sales data from St. Louis Federal Reserve Bank using data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, interest rate data from Freddie Mac, and mortgage cost calculations by Essent IQ assuming $1200 in annual property taxes and a $25,000 downpayment. Income requirements are based on a 30% debt-to-income (DTI) ratio.

###

The National Housing Conference has been defending the American Home since 1931. NHC is a diverse continuum of affordable housing stakeholders that convene and collaborate through dialogue, advocacy, research, and education, to develop equitable solutions that serve our common interest – an America where everyone is able to live in a quality, affordable home in a thriving community. Politically diverse and nonpartisan, NHC is a 501(c)3 nonprofit organization.