By David M. Dworkin

The United States is in the midst of a growing and unprecedented housing crisis that in many ways is, a tale of two very different housing markets. In communities with vibrant and growing economies like Denver, Colorado; Ann Arbor, Michigan and Nashville, Tennessee, it is a crisis of affordability. But in cities like Detroit, Michigan; Cleveland, Ohio and Memphis, Tennessee, as well as most rural communities, the opposite situation creates its own set of problems. There, home values are actually so low, and the costs of making a mortgage are so high, that lenders and builders can’t afford to produce and finance homes that are affordable to those who need them the most. The result is that most first time homebuyers either can’t buy homes they can afford, or can’t afford homes they need.

This strange crisis is a new one for our housing market; nothing like the bubble of housing values that devastated home prices and neighborhoods across the country during the Great Recession. It is emblematic of a housing construction and finance system across the country that is in dire need of repair. This is why your membership in NHC and participation in one or more of the sub-groups to help draft a new National Housing Act for the 21st century is so important. Please join us or renew your membership today!

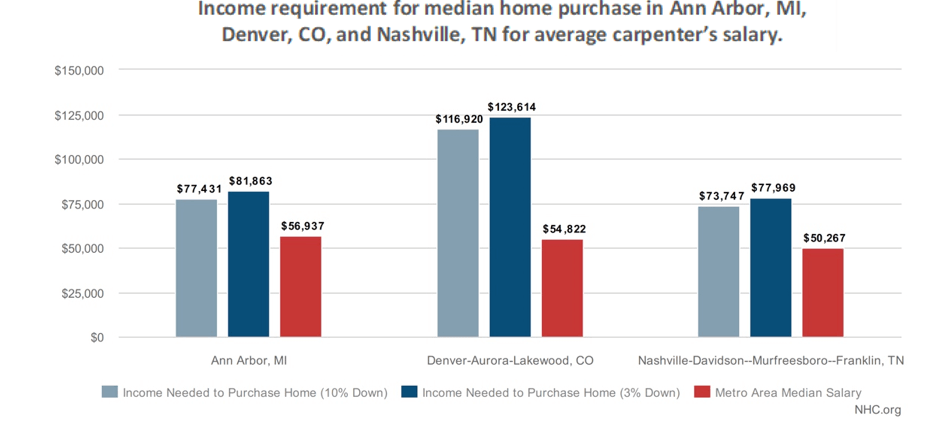

As the National Housing Conference’s Paycheck to Paycheck database makes clear, it’s not just high-cost coastal communities like San Francisco but places like Nashville, Tennessee and Denver, Colorado, where a carpenter cannot afford to live in a home that he or she built.

Unfortunately, this affordability crisis is only going to get worse. Tight credit, especially among lower income borrowers, and Byzantine zoning and financial regulations are adding to the pressure on new construction and rehabilitation of existing units. When you account for new household formation and obsolescence nationwide, we are losing up to 250,000 to 500,000 units of housing annually, according to most economists. We are simply not building nearly enough housing where we need it.

In the low cost cities, however, the problem is that prices are too low. Why is this a problem? It’s because the cost of most homes are well below the nearly $200,000 break-even point for making a typical mortgage. Building and permitting costs add to this by making the development of new homes uneconomic in cities and counties with the most affordable homes, that are often in most need of major repairs. For these existing homes, rehab costs often exceed the appraised value of the home after the work is completed.

To help address this problem, NHC and several of our members like the National Association of Affordable Housing Lenders, the Local Initiatives Support Corporation, Enterprise Community Partners, and the National Community Stabilization Trust have developed legislation to bridge the appraisal gap. It would convert Michigan’s nearly $2.8 billion in unused housing bond authority into a tax credit sold to investors that would directly help homebuyers and homeowners close the appraisal gap.

To address the high cost of housing where so many of the new jobs are, we need to reform our zoning regulations and build more affordable housing, like apartment buildings that have affordable units large enough for a family to live. Minneapolis, Minnesota has led the way in this area, ending a century of single family only zoning that keeps lower income families out of high opportunity neighborhoods.

These kinds of changes are often opposed by NIMBYism (Not In My Back Yard), but as residents of Los Angeles, California have learned the hard way, NIMBYism can easily result in an explosion of homelessness – in their front yard. Every day in Los Angeles, over 4,000 people wake up in a tent or car, wash up in a Starbucks or McDonalds bathroom, and go to work every day. Much of Detroit’s homeless population lives in vacant and abandoned homes, but don’t count on them remaining invisible forever.

These dual housing crises are not impossible to solve, but they will take political will and action to overcome. We can work together to change course. If we don’t, these crises will only get worse. I hope you will join housing leaders on Dec. 3 and 4 at our Solutions for Affordable Housing convening in D.C. to discuss working together on solving these crises and more. You can register here.